Inherited ira required minimum distribution calculator

This calculator has been updated to reflect the new. The life expectancy factor for your current age.

Sjcomeup Com Rmd Distribution Table

Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account.

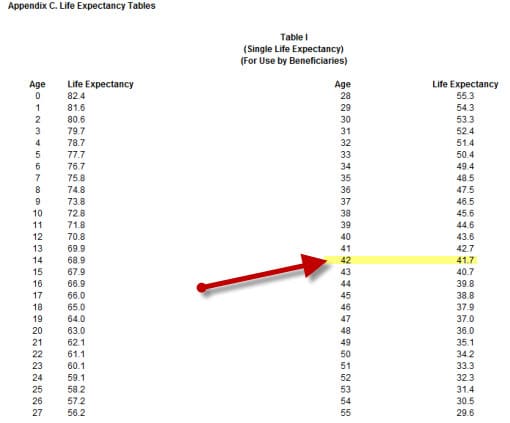

. You do not have to take an RMD from your workplace. To calculate RMDs use Table I to find the appropriate life expectancy factor. If you were born on or after.

Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022. Inherited IRA Death before Required Beginning Date. You can find it in Appendix B of IRS Publication 590-B.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Your Required Minimum Distribution this year is 0 How is my RMD calculated.

This is your required minimum distribution for this year from this IRA. If you want to simply take your inherited money right now and pay taxes you can. How is my RMD calculated.

Inherited IRA Distribution Calculator Determine the required distributions from an inherited IRA The IRS. But if you want to defer taxes as long as possible there are certain distribution requirements with which you. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. RMDs for Inherited IRAs are calculated based on two factors. Inherited IRA Death after Required Beginning Date.

Comparison Calculator RMD Calculator Estimate your Required Minimum Distributions RMDs. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required. The IRS requires that you withdraw at.

If you are a beneficiary who was taking required minimum distributions prior to 2022 based on your life expectancy in the year following the owners. This calculator has been updated for the SECURE Act of 2019 and CARES. The account balance as of December 31 of the previous year.

Traditional IRA Calculator Determine your eligibility for a Roth or Traditional IRA. If you have questions please consult with your own tax. April 1 Deadline for the first RMD in the year after you turn 72.

There are no RMDs for Roth IRAs unless they are inherited. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. If you move your money into an inherited IRA you withdraw RMDs based on your age.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Paying taxes on early distributions from your IRA could be costly to your retirement.

Line 1 divided by number entered on line 2. Repeat steps 1 through 3 for each of your non-inherited IRAs. Under the 10-year rule the value of the inherited IRA needs to be zero by Dec.

Determine beneficiarys age at year-end following year of owners. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Quoting Pub 590-B.

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Ad Search For Info About Your Query. If the deceased IRA owner was required to take a distribution in the.

As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. RMD amounts are based on your age and are recalculated each year based on factors in the IRS. You can also explore your IRA beneficiary withdrawal options based.

31 on the 10th anniversary of the owners death. This is the factor associated with your. The SECURE Act of 2019 changed the age that RMDs must begin.

Calculate the required minimum distribution from an inherited IRA. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules and the CARES Act of 2020 RMD waiver. The Bottom Line If you inherit an IRA you are.

During her ages of ten through 18 an RMD must be. This calculator has been updated to reflect the new. 36 rows aka Minimum Required Distribution Calculator This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from.

The 10-year rule will kick in requiring any remaining funds in the inherited IRA to be wholly distributed within ten years. Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

Account balance as of December 31 2021 7000000 Life expectancy factor. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

Distribute using Table I. Browse Get Results Instantly.

Sjcomeup Com Rmd Distribution Table

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Rmd Table Rules Requirements By Account Type

Sjcomeup Com Rmd Distribution Table

Rmd Calculator Required Minimum Distributions Calculator

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Required Minimum Ira Distributions Tax Pro Plus

Rmd Table Rules Requirements By Account Type

Ira Required Minimum Distribution Table Sound Retirement Planning

Required Minimum Distribution Rules Sensible Money

Rmd Tables

Rmd Tables

Required Minimum Distributions Rules Heintzelman Accounting Services

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Required Minimum Distributions For Retirement Morgan Stanley

Required Minimum Distribution Calculator

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More